Recently, the Federal Government read proposed Bill C-2 (aka The Strong Borders Act) for the first time in the House of Commons.

Proposed Bill C-2 addresses securing of the border, combatting transnational organized crime and illegal fentanyl and disrupting illicit financing.

These topics relate directly to how AML functions in Canada and builds upon the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) changes outlined in the 2024 Fall Economic Statement, bringing potential critical updates to Canada AML/ATF regulations.

Now, let’s double click on some key points from the proposed Strong Borders Act (Bill C-2) that would directly affect your AML compliance, if enacted 🖱️

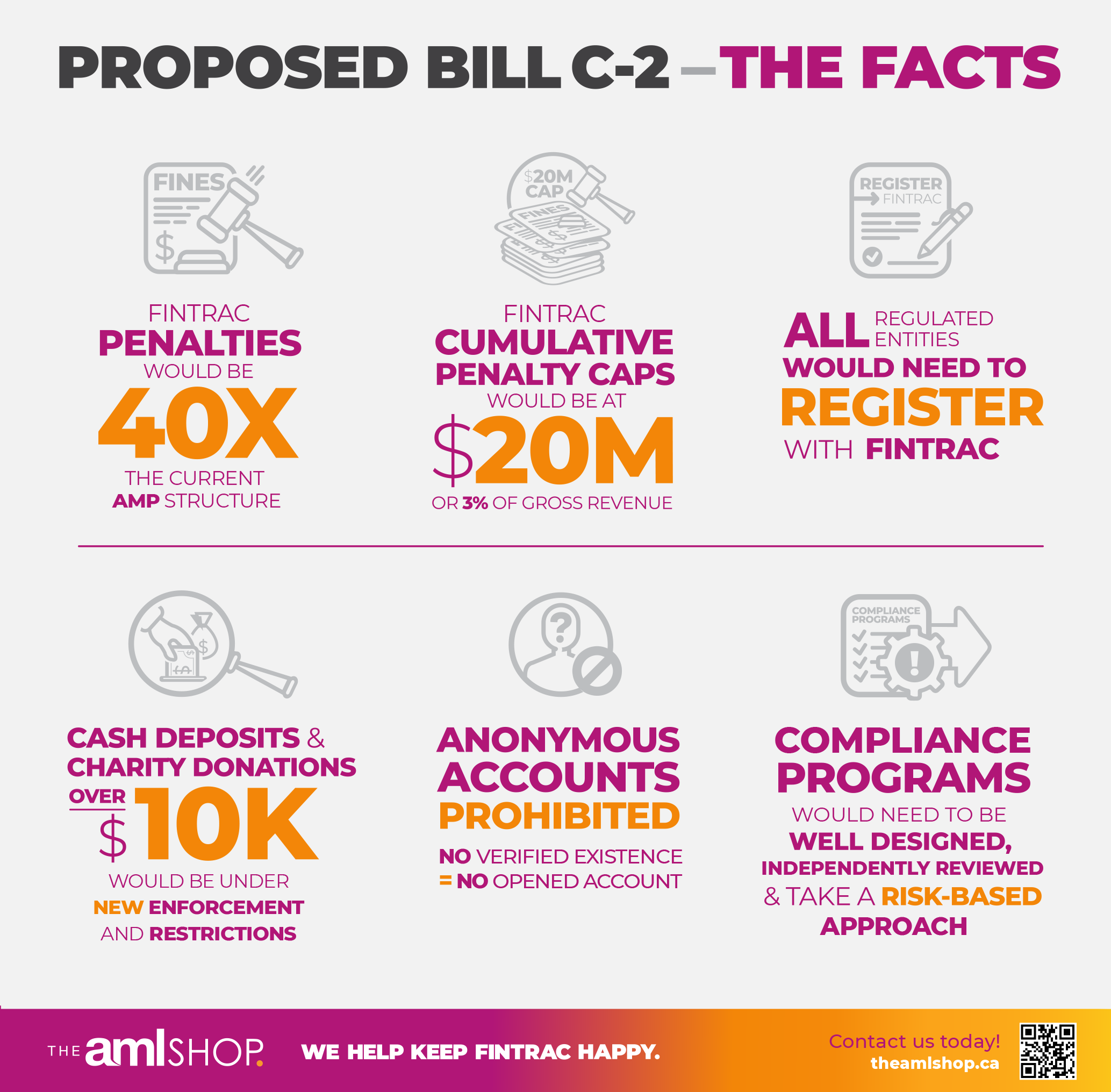

➡️ Higher FINTRAC penalties and new cumulative caps are expected. If enacted, this bill would authorize FINTRAC to penalize up to 40X the current penalty structure. This means maximum penalties for very serious offences could skyrocket up to $20 million per offence. For cumulative violations, there would be a cap set at $20 million or 3% of gross revenues.

As you can imagine, for high revenue entities - multiple violations could result in penalties of hundreds of millions of dollars or higher 💸

➡️ FINTRAC Registration Requirements would broaden. Similar to MSBs, all PCMLTFA reporting entities would have to be registered with FINTRAC and maintain their registration. If you don’t register or maintain registration, you could face consequences which could even potentially include the possibility of criminal charges.

Registration processes take months now, with only several thousand registrants. Prepare for a far longer delay when 30,000 businesses have to go through registration processes. And look out for our article on managing the risks of registration delays to business relationships…coming soon.

Keep fear of regulators at bay. We can help you, just like we have helped 100’s of other companies and MSBs in their registration process. 🤝

➡️ New rules regarding cash transactions and deposits would be established. In an effort to curb the use of cash to launder money, there are new proposed restrictions on cash deposits and transactions over $10,000. Additionally, no charities would be allowed to accept cash deposits greater than $10,000.

Further, financial entities would not be allowed to accept third party cash deposits. These big shifts if enacted are unprecedented and would greatly impact industries like Real Estate, Money Services Businesses, Financial Institutions and Credit Unions.

And we already know what you are thinking…questions about how to enforce compliance under these rules and issues in verification of “depositors” will surely be an ongoing, hot discussion topic.

You may want to leverage our experts in these potential “grey area” situations to ensure your compliance 💪

➡️ Anonymous Accounts prohibition. Although this may seem obvious and already enforced, there is more to it than you might imagine. This amendment to the PCMLTFA would prohibit any anonymous accounts from being opened. However, if you dig under the surface, what this would really mean for regulated entities is that an account is deemed anonymous if the account opener cannot be verified under existing identity verification requirements.

No verified existence = no opened account 🚫

➡️ More scrutiny of compliance programs and effectiveness reviews. FINTRAC would take a harder stance on its review of compliance programs and their component elements. FINTRAC would have the ability to levy fines and penalties where compliance programs and documents may exist, but perhaps not in FINTRAC’s judgement of being effective in mitigating money laundering, terrorist financing and sanctions risks.

The current standard of having a documented, written compliance program would no longer cut it. It would have to be effective…not just tested routinely for its effectiveness.

And, failure to meet FINTRAC’s new compliance program standards in this proposed regime could result in a serious violation and cost your company millions of dollars in penalties.

What’s tricky is understanding and knowing exactly what regulators are looking for here…as we predict it will be highly subjective and industry specific. Remember, our experts have been involved in numerous FINTRAC exams and we have seen how things typically play out during an examination. Our in-depth experience in this area can help evaluate the benchmarks appropriate for your business and industry.

Because of the subjective nature of these new requirements, having an AML Shop expert on your side could save you a ton of headache. 💆

Conclusion:

As you can see, Proposed Bill C-2 could shake up how AML functions in Canada; the good news is that we can help you achieve and maintain compliance with ease.

Reach out to our experts today at contactus@theamlshop.ca if you have any questions about these proposed changes and in the meantime, please refer to our Strong Borders Act (Bill C-2) & AML Infographic to keep these details top of mind.

We Help Keep FINTRAC Happy.